What to Know about Interactive Brokers

Interactive Brokers (IBKR) is an American investment company. The company trades stocks, futures, EFPs, forex, bonds, funds, and cryptocurrencies.

IBKR is regulated by the US Security and Exchange Commission, the New York Stock Exchange, the Commodity Futures Trading Commission, the Financial Industry Regulatory Authority, the Chicago Mercantile Exchange, and other self-regulatory organizations.

Interactive Brokers, founded by Thomas Petterffy, has been in existence since 1978, which is approximately 45 years ago. While its headquarters is in the United States in Greenwich, Connecticut, the broker has other offices in four cities.

The company started in 1977 when it was established as a market maker under the name T.P & Co., and in 1982 it was renamed Timber Hill Inc. In 1979, they were the first to use fair value pricing sheets on an exchange trading floor and also the first to utilize handheld computers for trading in 1983. The company pioneered the first fully functional automated algorithmic trading system; it created and submitted market orders automatically. In the early 90s, they established the Interactive Brokers Group and created a subsidiary called Interactive Brokers LLC to deal with electronic brokerage separately from Timber Hill, which controls market making. The company emerged as the first online broker to offer direct access to IEX(Investors Exchange), a private forum for trading securities in 2014.

Why trade forex with Interactive Brokers?

Interactive Brokers is an excellent online broker with a wide range of features that differentiate it from its competitors. The features make it one to beat and a good option for anyone interested in forex trading. Here are a few convincing reasons why you should trade forex with Interactive Brokers:

- Competitive fees: Interactive broker aims to provide their investors with the best possible value by offering favorable spreads and low commissions with no hidden fees. This enables traders to retain a huge percentage of their profits and optimize their trading abilities

- High-quality research and education: IBKR provides extensive educational materials, which include writings, videos, and webinars from fundamental concepts to advanced trading strategies. This helps traders to have knowledge and technical know-how to make good trading decisions.

- Variety of currency pairs: Interactive Brokers offers a wide selection of currency pairs to choose from, which includes major, minor, and exotic currency pairs. Each pair has its own characteristics and trading options. Thus, the company offers the flexibility of trades to traders.

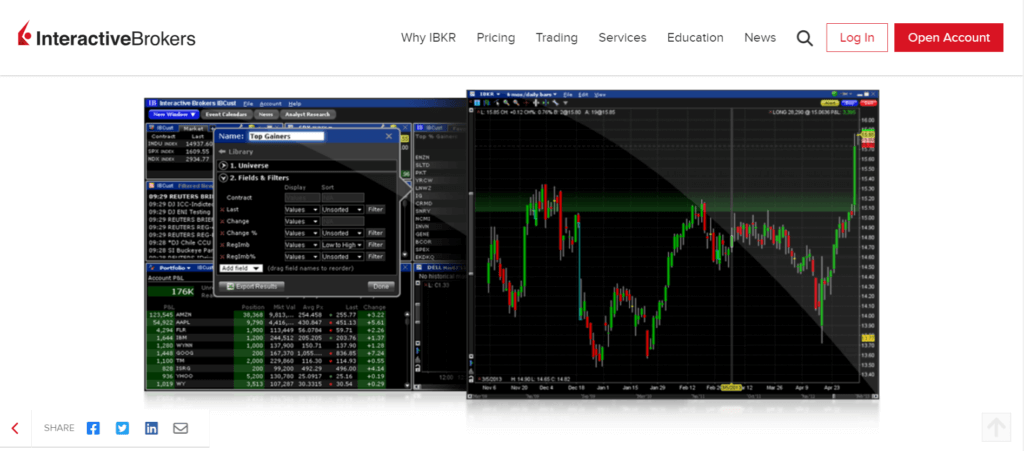

- Advanced trading tools: IBKR offers a variety of advanced trading tools to give their traders an edge in the competitive markets. These tools include customizable trading algorithms, up and down indicators, pending trades, and Integrated stock window(ISW). Traders can also access real-time market data and news feeds. IBKR proposes APIs for those who want to develop their own trading applications.

What forex pairs do interactive Brokers offer?

Forex pairs are combinations of two distinct currencies traded in the foreign exchange market. IBKR offers 100+ currency pairs on 24 currencies, making it very easy for traders to trade a wide range of currency pairs, therefore diversifying their portfolios and potentially maximizing return. The table below shows the major forex pairs that Interactive Brokers have to trade.

Types of major forex pairs

| Forex pair | Currencies in the pair |

| GBP/USD | British Pound and US Dollar |

| EUR/USD | Euro and US Dollar |

| USD/JPY | US Dollar and Japanese Yen |

| AUD/USD | Australian Dollar and US Dollar |

| USD/CHF | US Dollar and Swiss Franc |

| USD/CAD | US Dollar and Canadian Dollar |

| NZD/USD | New Zealand Dollar and US Dollar |

When it comes to major forex pairs, there are four traditional ones that are widely recognized. Nonetheless, it’s vital to point out that the most traded pairs may fall outside the category of traditional majors. Even though AUD/USD is the fourth most traded pair, it is not considered a traditional major. These four traditional pairs are:

1. EUR/USD

2. USD/JPY

3. GBP/USD

4. USD/CHF

What are Interactive Brokers features?

Interactive Brokers has exceptional features that provide their U.S. customers with an outstanding trading experience. Here are some of the key features:

- Wide range of financial assets: IBKR offers a wide selection of financial assets, providing access to diverse markets and instruments. Aside from being renowned for its forex offering, this online broker offers stocks and bonds. This helps traders to take advantage of different trading opportunities.

- Mobile app: The interactive brokers mobile app lets traders trade various tradable instruments on the go through their mobile phones. The app has user-friendly interfacing, making navigating through the financial markets easy.

- Advanced Trading Platforms: IBKR offers advanced trading platforms to satisfy the needs of different traders like its flagship Trader Workstation (TWS) and Webtrader. These platforms have all the tools and features for exciting trades, analyzing markets, etc. So whether you are a well-seasoned trader or a newbie to trade, IBKR has all the tools to maximize profits.

- Deposit and Withdrawals: There are different payment options to make deposits and withdrawals convenient for traders, such as through a wire transfer, checks, bank transfers, and Paypal

- Security: IBKR has implemented different security measures to protect your information and funds. Security measures like Secure Socket Layer (SSL). This encryption helps safeguard passwords, personal data, credit card details, etc. Also, with the addition of two-factor authentication tion, trader’s accounts are highly secured.

- Margin Trading: Margin trading allows traders to lend funds to trade larger positions than their account balance. It’s essential to go through the margin requirements as there may be interests and other requirements.

- Customer support: You can reach out to Interactive brokers in the following ways. Firstly, through their website and mobile app, where you can find FAQs and tutorials. They also offer live chat, where you can chat with a customer care representative. You can also contact the customer support team through phone calls to speak directly to them about pending issues. However, note that the customer is only available on business days.

- Demo Account: A demo account allows you to practice trading before using your own money to trade. It is an essential feature IBKR offers because it helps to give you a risk-free experience to accustom yourself to their platform and some features.

- Educational resources: Interactive Brokers offers a wide range of educational materials to their customers, such as webinars, articles, videos, and live workshops. The online broker platform is keen on providing high-quality education to help traders improve their trading abilities.

- Portfolio analysis tools: IBKR helps to provide tools that give an in-depth analysis of your portfolio’s performance. You can examine your holdings and execute track scenarios to understand how different factors can affect your trade.

What are the Pros and Cons of Interactive Brokers?

Knowing the pros and cons of interactive broker is important because it helps our USA audience weigh both sides of the coin and help determine if Interactive Brokers is their best option. Here are some of the advantages and disadvantages:

| Pros | Cons |

| Competitive pricing and low commissions | Traders Workstation (TWS) may be too complicated for beginner traders |

| Free stocks and ETF Trading for U.S. customers | Bank cards are not available as a payment option |

| The first withdrawal is free for each month | Meta trader is not available as a different platform option |

| Wide range of financial assets to trade | |

| Supports all types of accounts, such as retail, trading group, retirement, and institutional accounts |

How do you open an account with Interactive Brokers?

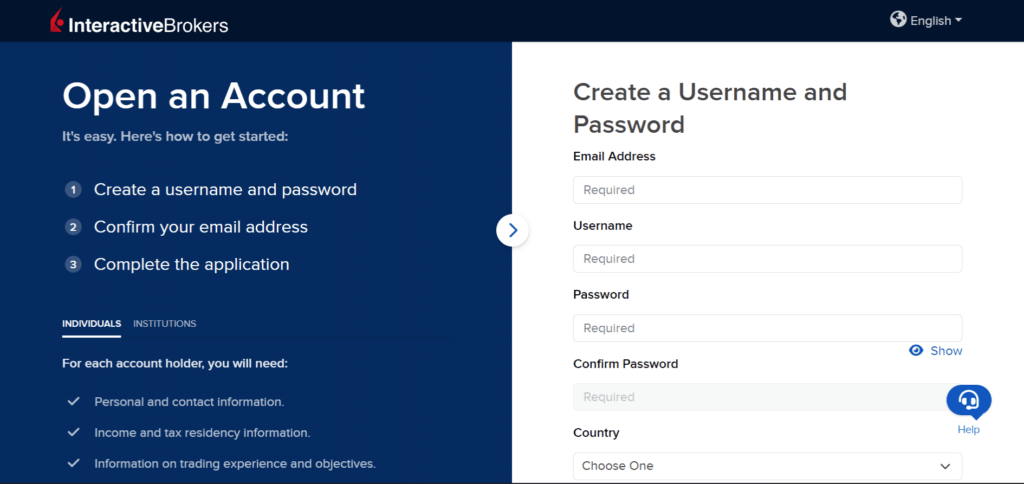

Are you looking to open an account with Interactive Brokers? Here are some steps to guide you on how to go about the process:

- Visit Interactive Brokers website: Upon a successful visit of their website, there’s an ‘open account’ button situated at the top right of the screen you are expected to click.

- Create a username and password: Fill in your personal details like email address, username, password, and country of residence.

- Confirm your email address: A confirmation Link will be sent to your email address. You are expected to verify your account.

- Log in to your account: Now, you can log in to your account with the username and password you just created.

- Select an account type: You are required to select your specific brokerage account type, whether individual, joint, retirement, or custodian account, and also select your state and select your service plan (lite or pro account). To trade forex, select the individual account type.

- Fill in your contact information: Fill in your name, contact address, city, state, postal code, phone number, date of birth, social security number, and so on.

- Provide your financial information: Provide your employment status, source of wealth, investment objectives, and purpose of trading.

- Cross-check the information filled: Go over all personal and contact information to confirm if all your details are correct.

- Agree to the terms and conditions: Make sure you read the terms and conditions before consenting to them and sign to complete the process.

- Fund your account: You will need to deposit into your account to begin trading. There are various payment options such as wire and check deposits.

What are Interactive Brokers ratings?

When traders are deciding which brokers to work with, there are so many factors to consider. Here are some ratings that make traders want to work with Interactive Brokers:

- Minimum Deposit: Interactive Brokers does not require a minimum deposit to open an account, which is a good way to start. However a minimum deposit of at least $100 is required for trading. Rating: 8/10

- Demo account: Interactive Brokers’ demo account provides a comprehensive range of features, making it suitable for experienced traders. However, it may be overwhelming for beginners. Rating: 8/10

- Pricing/Fees: IBKR offers low commission rates and competitive spreads, giving traders the luxury of keeping their trading costs down. Rating: 9/10

- Security: The provision of SSL (Secure Socket Layer) and 2FA (two-factor authentication) on their mobile platforms protects trader’s personal and financial details from unwanted authorization. Rating: 8/10

- Trader education: Interactive brokers offer a variety of educational resources and tools to train and educate their members on risk management, trading strategies, and more. Rating: 7/10

- Customer support: Traders can contact IBKR via their 24/7 customer service team, whether by calls or live chat; the team is always ready to offer assistance. Rating: 7/10

- Beginner-Friendliness: The platform may not be beginner-friendly, as it has a complex user interface. However, it offers a simplified platform (IBKR Lite) for beginners. Rating: 8/10

- Trading Experience: The forex broker enables traders to choose their trading style based on factors such as account size, level of experience, and risk tolerance. Rating: 7/10

- Trading Platform Features: These include Trader workstation, option trader, and Algorithmic trading. These tools have helped many traders to maximize their profits efficiently. Rating: 8/10

- Currency Pairs: Interactive Brokers presents 100+ currency pairs with excellent trading costs and full support for advanced trading algorithmic solutions, making top broker. Rating: 8/10

How does Interactive Brokers compare to other forex brokers?

Interactive Brokers is a regulated company and has a good reputation in the online trading industry. IBKR stands out among other forex brokers with its amazing features, such as its wide range of currency pairs to trade on, competitive pricing and low commissions, a wide array of payment options, and responsive customer support.

| Minimum Deposit | $50 |

|---|---|

| Demo Account | Yes |

| Currency Pairs | 80+ |

| Customer Support | 24/5 |

Forex trading carries a high level of risk and is not suitable for all investors. Past performance is not indicative of future results, and you should carefully consider your financial situation and risk tolerance before participating.

| Minimum Deposit | $0 |

|---|---|

| Demo Account | Yes |

| Currency Pairs | 70+ |

| Customer Support | 24/7 |

Forex trading carries a high level of risk and is not suitable for all investors. Past performance is not indicative of future results, and you should carefully consider your financial situation and risk tolerance before participating.

| Minimum Deposit | $250 |

|---|---|

| Demo Account | Yes |

| Currency Pairs | 80+ |

| Customer Support | 24/5 |

Forex trading carries a high level of risk and is not suitable for all investors. Past performance is not indicative of future results, and you should carefully consider your financial situation and risk tolerance before participating.

| Minimum Deposit | $5 |

|---|---|

| Demo Account | Yes |

| Currency Pairs | 70+ |

| Customer Support | 24/5 |

Forex trading carries a high level of risk and is not suitable for all investors. Past performance is not indicative of future results, and you should carefully consider your financial situation and risk tolerance before participating.

| Minimum Deposit | $250 |

|---|---|

| Demo Account | Yes |

| Currency Pairs | 80+ |

| Customer Support | 24/5 |

Forex trading carries a high level of risk and is not suitable for all investors. Past performance is not indicative of future results, and you should carefully consider your financial situation and risk tolerance before participating.