What to know about TD Ameritrade

TD Ameritrade is an electronic platform for trading financial assets like stock, futures contracts, mutual funds, cash management services, foreign exchange, and many more services. It grants its new investors access to an adequate and required amount of educational resources made in different formats across various topics.

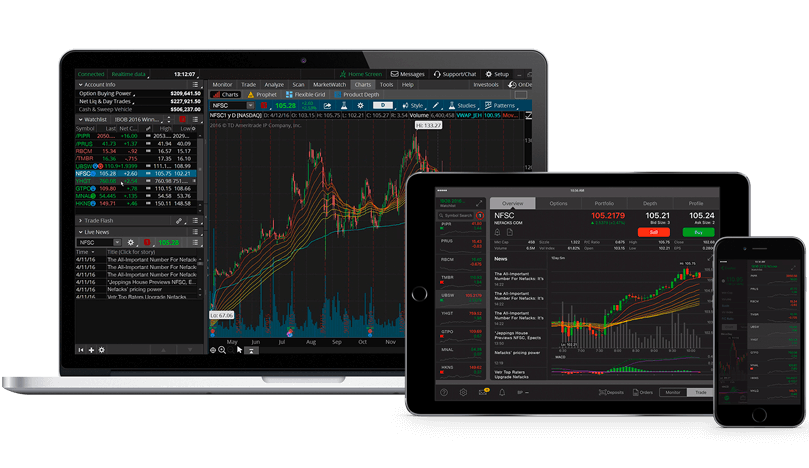

In 1971, when it was established, TD Ameritrade was a full-term broker in discount packaging. However, it has evolved over the years to build its brand as a high-ranking broker. Its user-friendly platform, Thinkorswim, combines advanced research appliances, financial calculators with the ability to backtest and screening facilities that allow investors to practice investment strategies based on historical data before advancing into the market.

TD Ameritrade’s wide investment options, low fees, outstanding customer support, and extended educational list attract investors from all walks of life. In 2020, TD Ameritrade was acquired by Charles Schwab and was renamed Schwab Trading. This acquisition, which is expected to be concluded by 2024, sees the integration of two of the best brokers in the US.

Why trade forex with TD Ameritrade?

TD Ameritrade is a reputable and distinguished broker known for its legitimacy, transparency, and unique features. Its features make it stand out greatly from its investment market competitors. The main reasons to trade with TD Ameritrade are as follows:

- User-friendly mobile application and website: TD Ameritrade has split users at the core based on their experience. For instance, casual investors follow the platform’s path for website and mobile, while more active investors would move towards Thinkorswim desktop and mobile. This provides users with a comfortable investment experience and compatible service across the platform’s various versions.

- Extensive trading tools and resources: TD Ameritrade provides necessary tools that allow its US clients to consistently work towards their choices of investment strategies regardless of how much they know or how long they’ve been trading.

- Vast quantity of educational content: The educational resources provided by TD Ameritrade allow the investors to build and improve their knowledge of the market and trading expertise. This feature is more important for beginners as it helps them feel more confident when they learn how to invest

- Offers top-class investment selections: On TD Ameritrade, US traders enjoy an extensive range of assets. Aside from trading forex, other investment instruments such as bonds, futures, and options can be traded.

What forex pairs does TD Ameritrade offer?

TD Ameritrade records about 70 different forex pairs. This allows traders to trade major, minor, emerging markets, and exotic pairs with competitive spreads. Some of the major pairs offered on TD Ameritrade are:

| Forex pair | Currencies in the pair |

| AUD/USD | Australian Dollar/ US Dollar |

| EUR/USD | Euro/US Dollar |

| GBP/USD | Great Britain Pound/US Dollar |

| USD/CAD | US Dollar/Canadian Dollar |

| USD/JPY | US Dollar/Japanese Yen |

| AUD/CAD | Australian Dollar/Canadian Dollar |

| USD/CHF | US Dollar/Swiss Franc |

| GBP/EUR | Great Britain Pound/Euro |

| EUR/JPY | Euro/Japanese Yen |

The above-listed pairs are the most commonly used forex pairs. However, amongst these pairs are four major traditional forex pairs. These pairs are not necessarily known as traditional pairs based on their trading volume. These pairs include:

- GBP/USD

- USD/CHF

- USD/JPY

- EUR/USD

What are TD Ameritrade’s features?

TD Ameritrade has exclusive trading features that distinguish it from other brokers. These features allow them to offer their clients the best trading experiences. Some of these features are:

- Forex education: By providing adequate and standard investment learning materials and other educational resources, TD Ameritrade enables its customers to study the forex market extensively.

- Trading tools and platforms: TD Ameritrade’s trading platform, Thinkorswim, is available for both desktop and mobile users. This allows trading enthusiasts to use their most preferred platform conveniently.

- Demo account: Before deciding to trade on TD Ameritrade, intending traders can practice their investment strategies based on historical charts on the trading platform. This allows traders, especially new traders, to familiarise themselves with the nitty-gritty of trading.

- Deposits and withdrawals: Every broker has a deposit and withdrawal system, but only a few have systems as exquisite as TD Ameritrade. It accepts electronic banking, wire transfers, checks, account transfers from another firm, and physical stock certificates for deposits and withdrawals.

- Commission and fees: This is another enticing feature for TD Ameritrade users. The broker charges no commission or fee on US exchange-listed stocks, ETFs, and options. Economic calendar: TD Ameritrade has also made provision of an economic calendar to help its clients keep tabs on the market. This calendar would help the clients identify reasonable and significant events with their impacts on the market.

- Security: TD Ameritrade helps their clients secure their personal information and accounts by providing some security products like antivirus. It also guarantees the protection of the assets and liabilities of its customers.

- Customer support: Another exciting feature of TD Ameritrade is the customer support it provides to its customers. The support team has experienced and licensed representatives with a contact number divided into several segments.

What are the Pros and Cons of TD Ameritrade?

Everything in life, including forex trading, has positive and negative aspects. Being a foreign exchange broker, TD Ameritrade has ups and downs. Let’s explore and compare the pros and cons of TD Ameritrade, which would help you take decisive action and also help you determine if it is the best broker option for you. The pros and cons are as follows.

| Pros | Cons |

| TD Ameritrade offers over 70 tradable currency pairs, providing traders with a diverse range of options | TD Ameritrade does not allow the use of bank cards and electronic wallets for money transfers. |

| It provides traders with tools, research, and educational resources | Post-merger TD Ameritrade/Schwab platform unknown |

| TD Ameritrade has a well-designed mobile app and website | Inactivity fee policy. Traders who do not actively maintain their account may incur these fees. |

| Excellent customer support, which can be beneficial for traders who may require assistance | |

| TD Ameritrade is publicly traded and regulated in four tier-1 jurisdictions. | |

| Provides access to other global markets, but primarily focused on US markets |

How to open an account TD Ameritrade

Creating an account with TD Ameritrade is easy for both United States residents and international customers residing in countries where TD Ameritrade is available. There are six simple steps to create an account. They are:

- Begin the application process: Simply navigate your way to the application page. On this page, fill in the basic information requested and select the preferred type of account to be opened

- Provide the necessary information: This is where personal information such as date of birth, email address, social security number, and employment information would be requested. This should be filled appropriately with the correct details. A question about if you have a relative who works or is a director of any stock brokerage, a reply of No is advised.

- Review and edit information: Here, all that is required is to carefully glance through the application form, inspect the information provided, and correct any mistakes observed.

- Agree to terms and conditions: Carefully read the Terms and Conditions of TD Ameritrade and understand their rules and regulations. Ensure you have no problem with the terms and conditions before accepting it.

- Set up your login information: The next step is to set the login information you want to use. Provide a unique user ID that is peculiar to you and also a very secure and private password. The provided information would then be used for continuous logging into the account.

- Fund the account: After successfully providing the required information, the final step to begin trading is to simply fund the account with any amount you choose.

What are the ratings of TD Ameritrade?

This rating is based on the broker system’s important feature, which can help influence your decision-making in trading with TD Ameritrade. These are some rated factors:

- Minimum deposit: TD Ameritrade does not require a minimum deposit to open an account, making it accessible for investors of all levels. Rating: 10/10

- Demo account: TD Ameritrade offers a paperMoney virtual trading platform, which allows users to practice trading strategies without risking real money. This feature is beneficial for beginners and experienced traders alike. Rating: 9/10

- Pricing/Fees: TD Ameritrade offers commission-free trading for stocks, ETFs, and options. However, there may be fees for certain services, such as mutual funds and broker-assisted trades. Rating: 8/10

- Security: TD Ameritrade takes security seriously and employs various measures to protect customer accounts and information. These include encryption, firewalls, and two-factor authentication. Rating: 9/10

- Trader education: TD Ameritrade provides a wealth of educational resources, including articles, videos, webinars, and in-person events. These resources cover a wide range of topics and are suitable for both beginners and advanced traders. Rating: 8/10

- Customer support: TD Ameritrade offers customer support via phone, email, and live chat. They have a reputation for providing prompt and helpful assistance to their customers. Rating: 7/10

- Beginner-Friendliness: TD Ameritrade is beginner-friendly, offering educational resources, a user-friendly trading platform, and a demo account for practice. They also provide support for new investors who may have questions or need guidance. Rating: 7/10 .

- Trading Experience: TD Ameritrade provides a comprehensive trading experience with a wide range of investment options, including stocks, ETFs, options, futures, and forex. They offer advanced trading tools and platforms, such as thinkorswim, which is highly regarded by active traders. Rating: 8/10

- Trading Platform Features: TD Ameritrade offers a variety of trading platforms, including the web-based thinkorswim platform, which is known for its advanced features and tools. The platforms are user-friendly and provide access to real-time market data, research, and analysis. Rating: 8/10

- Currency Pairs: TD Ameritrade offers forex trading with a wide range of currency pairs. Traders can access the forex market through the thinkorswim platform, which provides advanced charting and analysis tools. Rating: 8/10

How does TD Ameritrade compare to other forex brokers?

Since its establishment in 1971, TD Ameritrade has earned itself a reputation as a top-tier broker amongst ancient and modern brokers. Schwab is also a highly-rated broker when compared with its peers. The integration of these two top-class brokers has given room for advanced and improved trading experience on the developed Schwab trading.

| Minimum Deposit | $50 |

|---|---|

| Demo Account | Yes |

| Currency Pairs | 80+ |

| Customer Support | 24/5 |

Forex trading carries a high level of risk and is not suitable for all investors. Past performance is not indicative of future results, and you should carefully consider your financial situation and risk tolerance before participating.

| Minimum Deposit | $250 |

|---|---|

| Demo Account | Yes |

| Currency Pairs | 80+ |

| Customer Support | 24/5 |

Forex trading carries a high level of risk and is not suitable for all investors. Past performance is not indicative of future results, and you should carefully consider your financial situation and risk tolerance before participating.

| Minimum Deposit | $5 |

|---|---|

| Demo Account | Yes |

| Currency Pairs | 70+ |

| Customer Support | 24/5 |

Forex trading carries a high level of risk and is not suitable for all investors. Past performance is not indicative of future results, and you should carefully consider your financial situation and risk tolerance before participating.

| Minimum Deposit | $100 |

|---|---|

| Demo Account | Yes |

| Currency | 100+ |

| Customer Support | 24/7 |

Forex trading carries a high level of risk and is not suitable for all investors. Past performance is not indicative of future results, and you should carefully consider your financial situation and risk tolerance before participating.

| Minimum Deposit | $250 |

|---|---|

| Demo Account | Yes |

| Currency Pairs | 80+ |

| Customer Support | 24/5 |

Forex trading carries a high level of risk and is not suitable for all investors. Past performance is not indicative of future results, and you should carefully consider your financial situation and risk tolerance before participating.